When it comes to preparing kids for the future, saving for college has long been a top priority. Tools like 529 college savings plans have helped families set aside money for education while offering tax advantages along the way. But as financial goals evolve, and retirement security becomes a growing concern for younger generations, new proposals are emerging to expand how families plan for long-term financial health.

One of the most talked-about proposals is the Trump Retirement Account (TRA), introduced as a component of the One Big Beautiful Bill (BBB). While the legislation includes various changes, including new tax deductions for seniors and deducting interest paid on car loans, the TRA portion specifically targets long-term retirement savings for young Americans. Unlike the 529, which is focused on education, the TRA aims to give children a head start on retirement savings offering parents a new way to invest in their child’s financial future.

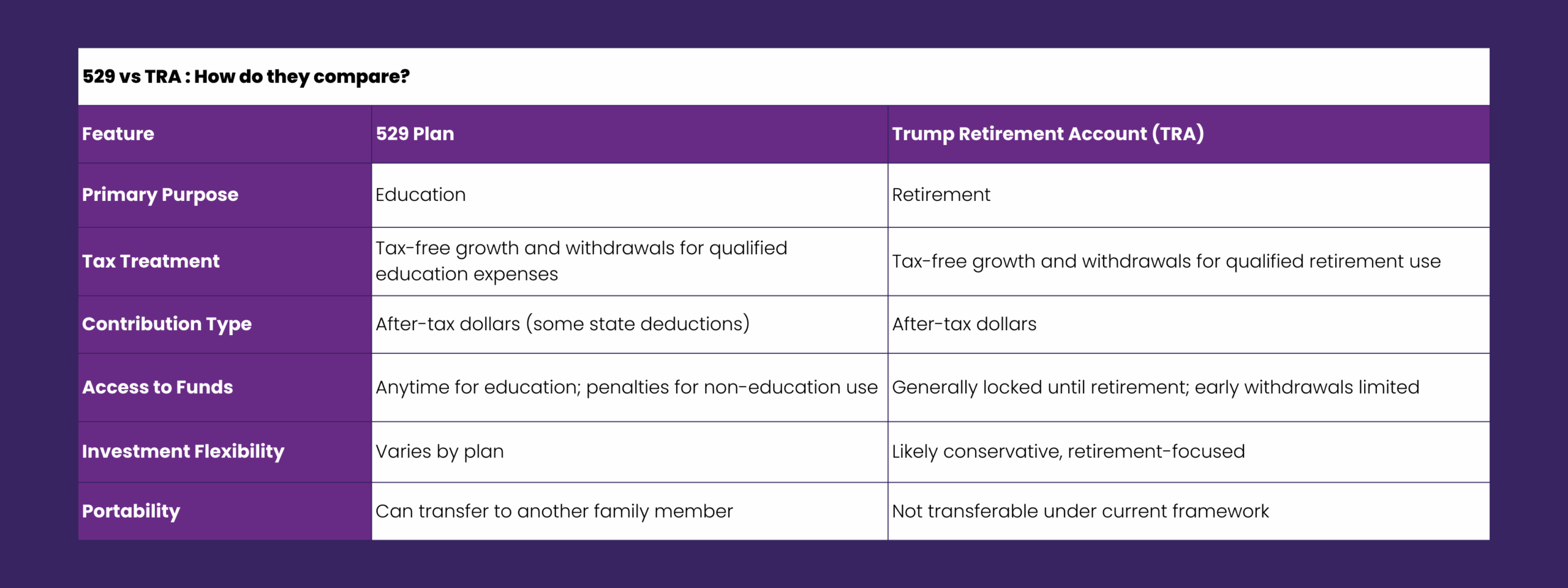

Here’s how the 529 plan and the TRA compare.

The 529 Plan

A 529 plan is a state-sponsored investment account designed to help families save for education. Contributions grow tax-free, and withdrawals are also tax-free when used for qualified education expenses like college tuition, fees, books, and room and board. Families are also allowed to use 529 funds for K–12 tuition and up to $10,000 in student loan repayment.

The appeal of 529 plans lies in their tax benefits, high contribution limits, and, in many cases, state-level deductions or credits. However, the downside is their limited flexibility. If your child doesn’t pursue higher education or needs funds for non-educational purposes, you’ll likely face taxes and a penalty on the earnings portion of the withdrawal. Some of this concern was assuaged with Secure 2.0 Act which allows 529 plans that have been maintained for the beneficiary for 15 years to be rolled over to a Roth IRA tax and penalty free. There is a $35,000 lifetime limit and the contributions are limited by the annual Roth IRA contribution limits.

What Is the Trump Retirement Account (TRA)?

The Trump Retirement Account is a new savings vehicle introduced as part of the One Big Beautiful Bill. Modeled somewhat after a Roth IRA, the TRA would allow parents and others to contribute up to $5,000 annually into an account for their child’s retirement. Those contributions would grow tax-free over time, and the funds could be withdrawn tax-free in retirement, assuming they meet the age criteria.

This proposal is intended to help younger Americans build long-term wealth by starting early. The TRA encourages parents to think about retirement planning not just for themselves, but also for their children. While the funds in a TRA would be designated specifically for retirement. There are exceptions to early withdrawal penalties for college tuition and first-time home purchases. This option is even more compelling due to the proposed $1,000 deposit made by the government for children (US Citizens with Social Security numbers) born between 2025 and 2028.

How do the 529 Plan and TRA Compare

While both the 529 and TRA are tax-advantaged savings vehicles that allow for long-term growth, they serve very different purposes. The 529 plan is focused on education, with flexibility for a range of schooling expenses but penalties for non-qualified withdrawals. The TRA, on the other hand, is intended for retirement and may be off-limits until your child reaches 59½.

Both options can be valuable, depending on your goals. If education is your main focus, a 529 is still a smart choice. But if you want to help your child build wealth for the long term, the TRA could become a powerful complement.

Which account is best?

As the financial landscape changes, families are seeking smarter ways to plan for their children’s futures. While the 529 plan remains a trusted option for education savings, the Trump Retirement Account introduces a new way to prepare kids for long-term financial health.

Each account has its place. The key is understanding how and when to use them and making sure your strategy matches your child’s goals and your family’s values.

Ready to create a plan that grows with your child as they grow from college and beyond? Let’s talk.